Trends in health benefits for retirees

Since the late ’90s there has been a growing shift away from employers providing group health and dental coverage for retirees. Increasing healthcare costs, provincial de-listing of services, an aging population and changes to accounting rules are the main culprits that are eroding coverage for post-employment. Read more

Are You Ready To Deal With A Critical Illness?

Consider the following facts:

- 40% of Canadian women and 45% of men will develop cancer during their lifetime

- In 2005, cardiovascular disease (heart disease, diseases of the blood vessels and stroke) accounted for 31% of all deaths in Canada

Advances in medical science means that you have a better chance of surviving a critical illness. However, a critical illness often is accompanied by a huge financial burden to you and your family. Read more

Five Financial Products You Should Own

By Brenda Spiering, Editor, BrighterLife.ca

You don’t need to be born with a silver spoon in your mouth to build wealth. With the right products, you can grow and protect a healthy nest egg.

Here are five key financial products that should be part of your plan:

1. Registered Retirement Savings Plan (RRSP)

As soon as you begin your working life, you should have a registered retirement savings plan (RRSP). It’s one of the most tax effective ways to save for retirement. You’re allowed to contribute up to 18% of your earned income from the previous year to a maximum of $22,450 for 2011. (If you’re a member of a group pension plan, your contribution room is reduced by your “pension adjustment,” an amount you’ll find listed on your T4.)

Contributions are tax deductible, meaning you can net a tidy tax refund while building your savings. Plus, you can turbo charge your RRSP savings by putting that tax refund back into your RRSP as soon as you receive your cheque.

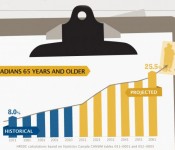

The Changing Face of Health Care in Canada

Canada’s aging population is going to have a significant impact on our health care needs and costs. According to The Sun Life Canadian Health Index, 90% of Canadians anticipate a financial impact if they were to experience a major or chronic illness. Yet only 58% are financially prepared to cover the cost of a serious illness. Are you prepared?